AI in Finance

Overview

A rapidly expanding discipline, artificial intelligence (AI) is reshaping businesses and the direction of technology. The financial sector is one area where artificial intelligence has made great progress. Financial organisations may automate tasks, acquire insights, and make better decisions with the help of artificial intelligence (AI) in finance, which combines advanced analytical and machine learning techniques.

Introduction

One of the biggest and most significant businesses in the world, the financial sector has always been at the forefront of innovation. From the usage of calculators and spreadsheets to more sophisticated tools like financial modelling software and trading algorithms, the use of technology in finance has developed dramatically over time. Artificial intelligence is the most recent technological innovation to shake up the financial sector.

To automate operations, gather insights, and make better decisions, artificial intelligence (AI) in finance uses sophisticated analytics and machine learning techniques. To evaluate huge amounts of financial data, find trends, and make forecasts, algorithms and models are used. AI in finance can completely change how financial organisations run, increase productivity, and offer clients better services.

What is AI in Finance?

To automate operations, gather insights, and make better decisions, artificial intelligence (AI) in finance applies sophisticated analytical and machine learning techniques. To evaluate huge amounts of financial data, find trends, and make forecasts, algorithms and models are used.

The financial sector produces large amounts of data, and AI aids in revealing its worth. Financial institutions may use AI to analyse and comprehend massive amounts of data in real-time and offer more precise and timely insights.

How is AI Powering the Future of Financial Services?

Financial institutions are using AI-powered technologies to automate labour-intensive operations, reduce operational costs, and open up prospects for revenue growth. Many people in the financial services sector have high hopes for AI. According to a recent NVIDIA poll of experts in the financial services industry, 83% of respondents believe that AI is crucial to the future success of their business.

Depending on the kind of financial firm, different approaches to applying AI were taken. Algorithmic trading, fraud detection, and portfolio optimization were the most often cited AI uses among fintech and financial firms. This indicates a priority on safeguarding and maximising client returns. On the other hand, fraud detection, recommender systems, and sales and marketing optimization were cited by banks and other financial organisations as their top AI use cases. Consumer banks develop AI-enabled applications for client acquisition and retention as well as cross-selling and up-selling individualised products and services in addition to focusing on fraud detection and prevention.

How does AI Impact the Finance Industry?

AI is having a significant impact on the finance industry by transforming the way financial services are delivered. It is enabling financial institutions to automate tasks such as data entry, fraud detection, and risk management. It is also helping to improve decision-making by providing insights and predictions based on data analysis. AI is also enabling financial institutions to offer personalized services to customers, which can help to improve customer satisfaction and loyalty.

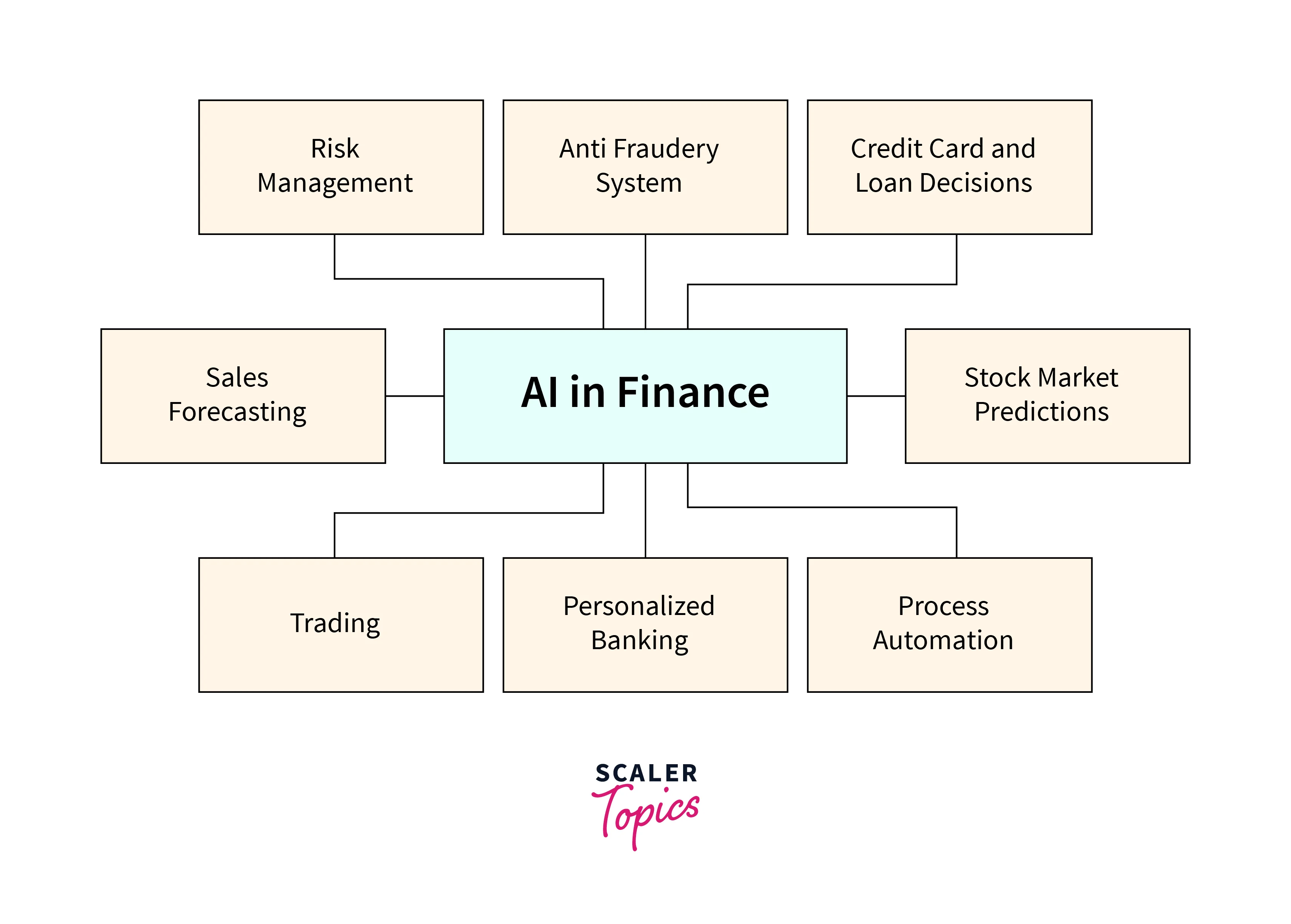

Applications of AI in Financial Services

We begin by outlining some of the major fields of the financial sector where artificial intelligence is having the biggest influence and adding the most value above conventional methods.

AI in Personal Finance

Managing income, expenses, investments, and savings is a complicated aspect of personal finance. There are several uses for AI in personal finance, including assisting people in better managing their finances. They consist of software for financial planning, investing platforms, and budgeting tools. AI is also being applied in personal finance to advance financial literacy and education.

One example of AI in personal finance is the app called Clarity Money, which uses machine learning algorithms to help users manage their finances. The app can analyze users' spending patterns and provide personalized recommendations on how to save money. It can also help users cancel subscriptions, negotiate bills, and find better deals on their recurring expenses.

AI in Consumer Finance

Consumer finance is a significant sector of the financial sector that involves offering people financial services. Consumer finance is utilising AI to enhance customer service and expedite procedures. AI is being used in consumer finance for a variety of purposes, including loan underwriting, fraud detection, and customer service. AI-powered chatbots can offer round-the-clock customer service, enhancing client happiness and loyalty. American Express is using AI to improve customer service and reduce fraud. Their AI-powered chatbot, called "Amex Bot," can assist customers with their accounts, provide information on their rewards programs, and even make payments. The chatbot can also detect suspicious activity and alert customers to potential fraud.

AI in Corporate Finance

Corporate finance involves managing the financial activities of companies, including risk management, investment decisions, and financial forecasting. AI is being used in corporate finance to improve decision-making and increase efficiency. AI models can analyze financial data and provide insights and predictions to help companies make better decisions. AI is also being used in areas such as financial reporting and auditing to streamline processes and reduce errors. JP Morgan Chase is using AI to improve their risk management and trading activities. They developed a machine learning algorithm called "LOXM," which can analyze financial data in real-time and detect anomalies that could indicate potential risks. This technology has helped the company identify and mitigate risks more quickly and efficiently than traditional methods.

What are the Benefits of AI in Finance?

AI can have a significant positive impact on banking and finance if it is strategically used.

Reduction in Operational Costs and Risk

Although the banking sector operates primarily digitally, it is nonetheless filled with manual, occasionally paper-intensive operations that rely on people. Because of the possibility of human mistakes in these procedures, banks face considerable operational costs and risk challenges.

In banking, robotic process automation (RPA) is being used to replace a lot of the labour-intensive and error-prone work involved in inputting customer data from contracts, forms, and other sources. RPA is software that mimics rules-based digital processes performed by humans.

Improved Customer Experience

There's a reason why banking hours were mocked. When you needed them most, like later in the day or on vacations and weekends, banks never appeared to be open. In the past, call centres were infamous for their long wait times and, when operators were finally engaged, they frequently failed to solve the customer's problem.

It is evolving as a result of features like up spelling and chatbots on call.

Automation of the Investment Process

Last but not least, some banks are digging even deeper into the area of AI by employing their clever algorithms to support their investment banking research and assist in making investment decisions. Companies like UBS, based in Switzerland, and ING, based in the Netherlands, are using AI systems to search the markets for undiscovered investment opportunities and provide guidance to their algorithmic trading systems. While all of these investment decisions are still being made by people, AI systems are finding new opportunities through improved modelling and discovery.

What are the Challenges of AI in Finance?

It only makes sense to talk about the potential difficulties associated with artificial intelligence after describing the primary areas in which it has an impact within the financial sphere.

Data Quality

"Garbage in, trash out" is a cliche used in the data science industry. Even while it applies to all data-related activity, the financial sector places a premium on it. Even just a few incorrect observations or one day's worth of distorted data can have devastating effects on the entire system, resulting in unsuccessful trades and financial loss.

Because of this, it is vital to have clean, vetted, and well-maintained data sources that are used as inputs for machine learning models in such crucial areas of the financial world. Also, there must be a rapid way to locate it throughout the entire pipeline, find the problem, and rectify it if anything untoward occurs with the data or something out of place is added. Some businesses operate under such theory and offer data version control similar to git.

Biased Data

Biased data can cause problems in financial organizations because the decisions made by AI can significantly impact the clients. For instance, biased data can result in unfair loan decisions, leading to loan applications being unfairly denied or approved. This can have a significant impact on a person's life, such as preventing them from buying a home or starting a business. To avoid such situations, financial organizations must take extra care to eliminate any sources of bias from the data used to train their AI systems.

Mitigating High-Dimensional Data Issues with Dimensionality Reduction

Financial firms deal with vast amounts of data that can be challenging for data scientists to process. A single transaction can involve hundreds of data points, resulting in low signal-to-noise ratios. However, when the number of features becomes too high, machine-learning approaches can struggle, and analysts must take steps to mitigate these issues. One approach is to carry out feature selection based on subject-matter expertise or automatically. Another method is to reduce the data's dimensionality to make it more manageable for machine learning algorithms to process.

Black Box

Data scientists are very keen to use the newest and best state-of-the-art approaches in many industries because they run a tonne of intricate computations in the background and produce really precise predictions. There is more to it in finance, even if it can often be a reasonable thing to do.

The financial sector is extensively regulated (and for good reason), and the institution is required to thoroughly comprehend many of the decisions made by algorithms. Imagine submitting a loan application and having it rejected due to a low credit score. Such a person could then submit a claim and ask for a thorough justification of all the circumstances surrounding the judgement.

Model explainability, therefore, has a critical impact on the financial sector. Even though using the most advanced neural network architecture might be alluring and offer a few extra accuracy percentage points (or other performance metrics used for evaluation), it is frequently not the best tool for the job and a simpler model (like logistic regression or a decision tree) is chosen in its place. This is so that the analyst can always explain the elements that influenced the decision when using such models.

Conclusion

- AI is rapidly reshaping businesses and technology, with significant progress made in the financial sector.

- AI in finance uses sophisticated analytics and machine learning techniques to automate tasks, acquire insights, and make better decisions.

- AI-powered technologies are helping financial institutions to automate labour-intensive operations, reduce operational costs, and open up prospects for revenue growth.

- AI is transforming the way financial services are delivered, enabling institutions to automate tasks, improve decision-making, and offer personalized services.

- Major fields of the financial sector where AI is having the biggest influence include personal finance, consumer finance, and corporate finance.

- Benefits of AI in finance include increased efficiency, improved decision-making, enhanced customer service, and better risk management. However, there are also challenges to be addressed, such as data privacy and ethical concerns.